Why We Need Wealth(y) Taxes – and How to Make Them Happen

A little extract from my book, the Inequality of Wealth: Why It Matters and How We Fix It on the debate that's about to get red hot.

In 1850s London, so the story goes, the great scientist Michael Faraday was demonstrating the mysteries of electromagnetism at the Royal Institution. Listening as Faraday described his work, a restless William Gladstone rudely interrupted him with the impatient inquiry: ‘But, after all, what use is it?’ Like a flash of lightning came the response: ‘Why, sir, there is every probability that you will soon be able to tax it!’

The anecdote captures a timeless truth. As long as humans have created wealth, societies have debated how fairly it should be shared.

Fast-forward to today, and the tax debate is about to hot up. That is a good thing because the simple truth is that British tax system is stuck in an outdated model. Despite a hundred fold increase in household wealth since I was born - and a doubling of under-taxed investment income this century - our tax rules are not fit for the scale, or secrecy, of 21st-century riches. From offshore accounts to avoidance schemes disguised as legitimate business, many of Britain’s richest still find ways to pay less tax than their cleaners. It’s time for that to change.

🚨 Carpet-Bagging and the Tax Gap

First things first. We simply do not collect enough of the tax that is owed.

The UK tax system is now bedevilled by a huge “tax gap”—the difference between what should be collected and what actually is collected. In 2023/24, that gap grew to a staggering £46.8 billion - the highest figure on record.

Now, we have been jailing people for tax avoidance since the days when Edward III threw his Chancellor, William de la Pole into the Tower for dodging customs duties on the wool trade. When I was writing my book, it was another Chancellor, Nadhim Zahawi, whose tax affairs were making the headlines.

While Mr Zahawi’s case was eventually settled, the episode underlined a core problem: too many of the wealthy go too many lengths to obscure what they owe, aided by aggressive tax advisors and a culture of opacity. Even in “honest” Scandinavian countries, studies show the richest 0.01% evade 25–30% of the personal taxes they owe. The issue isn't just individual—it's systemic.

🏦 Hiding Wealth in Plain Sight

Then we have the problem of hidden riches. Offshore tax havens, trusts, and complex corporate structures shield an enormous amount of global wealth. The latest data from the Tax Justice Network found that countries are now losing US$492 billion in tax a year to multinational corporations and wealthy individuals using tax havens to underpay tax.

This is not just an administrative headache. It’s a betrayal of the social contract. As Alex Cobham of the Tax Justice Network argues, we grant companies the privilege of limited liability in exchange for transparency. But secrecy has become the norm, not the exception. And of course, the challenge is not simply illegal behaviour. it ought to be what’s legal that should shock you.

🛠 The Five-Point Plan

My book argues that fixing the tax challenge starts with five smart steps:

Hire More Tax Inspectors

Every £1 spent by HMRC on compliance brings in £125 in tax. Yet before the election, the Department for Work and Pensions employs more staff on fraud detection than HMRC—and was prosecuting nearly 30 times more people. That needs rebalancing. The Government is finally making moves on this front. The HMRC hired an 400 extra compliance officers last year, and lo and behold, their inquiries into the tax affairs of the wealthiest Britons yielded more than £1.5 billion.

2. Create Better Anti-Avoidance Laws

The UK’s 2013 General Anti-Abuse Rule helps, but it’s still hard to prosecute schemes dressed up as legitimate financial advice. The Big Four accountancy firms and top law firms play a key role in lobbying for loopholes. We need rules that strike at intent, not just form.

3. Build a Global Asset Register

We need to know who owns what. Transparency on beneficial ownership—especially of UK property—is essential. The Economic Crime Act of 2022 made some progress, but blind trusts and offshore ownership still allow hidden wealth to flourish.

This Monday (30th June) is the deadline for the British OverseasTerritories (OTs) to honour commitments and meet the set deadlines to have registers of beneficial ownership. At the time of writing, most of them have failed to do so. Yet earlier this year, TJN found ‘A quarter of global tax dodging is enabled by the UK and British Overseas Territories’.

4. Parliamentary Oversight

Remarkably, Parliament has more oversight of MI6 than of HMRC. That must change. Tax policy is not just economics—it’s ethics. Parliament must regain control over who is taxed and how.

5. Fair Taxes for the Wealthy

Finally, we have to fix the unfairness that distorts our tax system - and in particular tax account of the huge change in the way people take income. Investment income has doubled over the course of this century - but it remains systematically under-taxed.

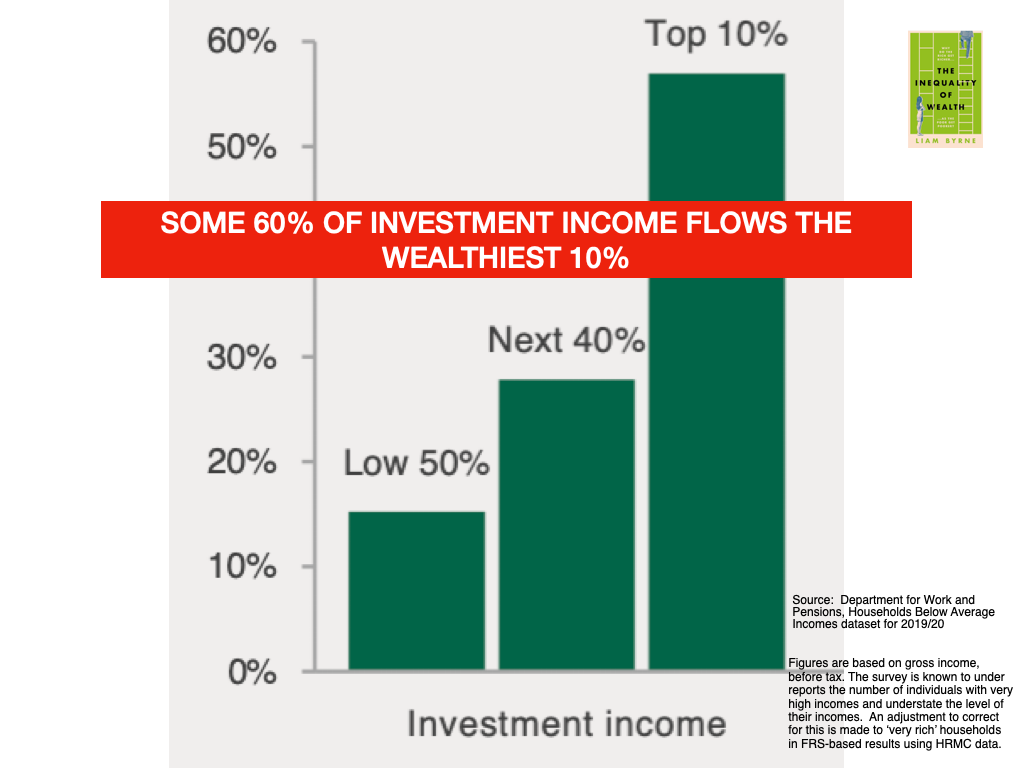

The richest 10% take 60% of all investment income—yet they often pay lower effective tax rates than middle earners. Dr Arun Advani and Dr Andy Summers found one in ten people earning over £1 million pays a lower tax rate than someone earning just £15,000.

This is because income from capital—dividends, capital gains, rental income—is taxed less heavily than wages. The government has made some positive moves on non-doms and inheritance tax - but raising capital gains tax, plugging CGT loopholes if people leave the country (as Arun Advani puts it, ‘pay your bill when you leave the restaurant’) and charging National Insurance Contributions on investment income (including on rental income if you’re a large scale landlord) would raise well over £20 billion a year. These aren’t radical proposals—they’re common sense.

Remember, since 2010, the wealth of the top 1% has risen by 31 times the wealth of everyone else. That's in large part because we all helped pay for £850 billion of quantitive easing (basically printing money).

This held interest rates down by almost 1% - and that cheap money helped inflate the asset values of those who already had assets.

Yet, if you get your money from investment income on these assets, you pay half the rate of tax of a top rate tax payer. Again, remember that sixty per cent of the investment income in Britain goes to the richest 10% of households. So, the richest enjoy a windfall (that we all paid for) and pay half the rate of tax on it of someone earning top rate wages. I just don't think that's fair

📊 Do Wealth Taxes Work?

The boldest idea in town is a net wealth tax on the richest fortunes. Ultimately that is the only way of decompressing the wealth inequality that has grown so sharply since the financial crash.

Traditional objections to wealth taxes include complexity, unfairness to “asset-rich cash-poor” pensioners and fears of capital flight. Yet the UK already taxes wealth through stamp duty, inheritance tax, and capital gains tax—just not very well. Combined, these bring in just 3.7% of total tax revenue.

So the Wealth Tax Commission proposed a modest 1% levy on assets over £10 million. That alone would raise £11.1 billion per year—and polling shows it is more popular than raising income tax.

🧠 Design Matters

I think implementing the tax right now would be hard because quite simply we lack a modern Domesday Book—an accurate, up-to-date picture of who owns what. That’s why we might need to start with a 0% “declaratory tax” above a £10 million threshold—just to gather the facts. From there, we can build fair and functional tax systems.

The virtue of this approach is that it focuses tax inspection on a small number of well documents fortunes - around 22,000 in fact. The tax could be levied annually for five years, with valuations based on open market value. “Asset-rich cash-poor” households could defer payments. Wealth hidden in blind trusts or shifted offshore would come into focus. The goal isn’t to punish success—it’s to prevent privilege from ossifying into unassailable power.

⚖️ A Moral Code for a Modern Economy

Tax isn’t just about revenue. It’s about justice. Bill Clinton called the tax code “an expression of a nation’s moral code.” Today, Britain’s tax code is too often a loophole-ridden script for unfairness.

Changing it will be hard. But, the inequality of wealth will not fix itself. But with political courage, smart design, and public support, we can begin to build a wealth-owning democracy that truly shares its harvest.

Take a look at the book, if you’d like the full chapter! It’s a great read: www.inequalityofwealth.co.uk

Thanks, Liam.

There’s a big gap between how the public grasps capital and how the wealthy wield it. We need to close that gap. Labour/other progressive MPs sharing this view should focus somewhat on retiring the old ‘nationalised X’ phrasing and reframe the NHS, other remaining assets and ex-public utilities as a *sovereign wealth fund* when the public understands that these are reliable assets generating returns that get reinvested in our services., we will start to make progress.

Perhaps we can frame this by highlighting the way the CRT manages its Sovereign Wealth Fund to finance upkeep of the waterways - if they didn't own this huge portfolio the waterways would regress to un-navigability in no time.

Or highlight the SWF that makes Norwegians the wealthiest per capita in Europe - not rocket science to explain it yet people who are 'working class'* don't have the same analysis of how wealth works that the wealthy do.

“I think it is a man’s duty to make all the money he can, keep all that he can, and give away all that he can.” — John D. Rockefeller

The super-wealthy are playing cup and ball with the crowd. Has anyone noticed how the same elements of the elite are financing the rise of the right - or is it just me? :-p

*- anyone who needs their salary to get by (include me...)

Speak to Patriotic Millionaires, they’ve been advocating paying more in tax for months.